Bumble stats

If you’ve been single at any period during the last eight years, you’ve more than likely been on Bumble in search of a date. Having launched in 2014, Bumble is similar to Tinder except it acts as more of a long-term relationship kind of app, as opposed to Tinder, which is more a casual hookup app. Similar to Tinder, Bumble is a dating app where you swipe left and right on potential matches.

Facts you probably didn’t know about Bumble

- Andrey Andreev, the creator of Badoo, made an early $10 million investment in Bumble and obtained 79% ownership.

- Whitney Wolfe Herd, Tinder’s VP of Marketing, established it after suing the dating app for sexual discrimination and winning a $1 million settlement.

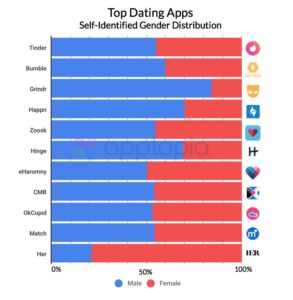

- Bumble has 46.2% female users, which is “better” than Tinder, which only has 33% female users.

- Only Women can start discussions, which is good for women who don’t want to be inundated with a flurry of messages from undesirable men.

- In 2020, it paid $22.5 million to resolve a complaint over the unfair auto-renewal of subscriptions.

Before this post, Bumble statistics were extremely hard to get and impossible to find. As a result, Bedbible conducted some pretty extensive research so that we didn’t have to. Cheers! They looked into every statistic and went over everything, including the number of active users on the app, the company’s estimated value, the present income and profitability, user demographics, and other info. Here’s what Bedbible uncovered.

- Bumble has 45.1 million active users Worldwide.

- Bumble has 1.8 million paying users

- Bumble made almost $900 million in 2021 alone.

- The average user spends $17.5 a year.

- Paying users spend $39 a month on average.

- Bumble has 14% of the online dating app market.

- Bumble is now valued at $8.1 billion, with a target valuation of $10 billion by 2025.

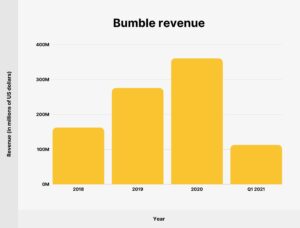

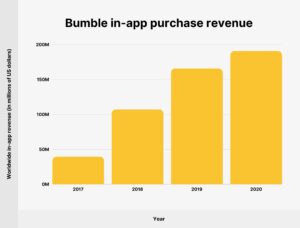

A little more than 3% of Bumble’s 45.1 million active users in 2021 paid for the app. By 2030, Bumble is anticipated to have 83 million active users. Bedbible looked at the amount of premium users to see how effectively it converts people into paying subscribers on their dating app. In the first two years of Bumble’s existence, there were no subscription fees or any in-app purchase options. In-app adverts were the source of earnings in the early years, which was peanuts compared to today’s revenue. By the end of 2023, Bumble’s yearly income is anticipated to climb by 30% year over year to approximately $1 billion.

Bumble’s market share

The most well-known online dating app in the world is of course, Tinder. It’s twice as big as Bumble but Bumble is actually the second most popular dating app, followed by Hinge, PoF (Plenty of Fish), Grindr and Badoo. Did you know that Bumble’s parent company also owns Badoo, giving them a combined 21% market share among the leading dating apps.

Average spend per user

Data analysts looked into the typical revenue spend by subscribers and uncovered that Bumble has a history of placing a high emphasis on user growth. They followed that up with a concentrated focus on converting active users into paying customers. The numbers speak for themselves:

| Average revenue per paying user | Average revenue per active user | |

| 2015 | $0 | $1.2 |

| 2016 | $0 | $1.3 |

| 2017 | $588 | $8.3 |

| 2018 | $380 | $8.6 |

| 2019 | $267 | $6.9 |

| 2020 | $330 | $8.0 |

| 2021 | $510 | $17.0 |

| 2022 | $496 | $17.5 |

| 2023 | $490 | $17.2 |

| 2024 | $473 | $18.6 |

| 2025 | $466 | $19.3 |

| 2026 | $461 | $20.1 |

| 2027 | $457 | $20.9 |

| 2028 | $454 | $21.9 |

| 2029 | $451 | $22.9 |

| 2030 | $448 | $24.0 |

Whether you’re a Tinder user, or prefer to seek connections on other apps such as Bumble and Hinge, there’s no denying Bumble is coming up right behind Tinder in terms of popularity and user spend. If these predicted valuations are anything to go by, Bumble might well be market leader in the future.

Join the BSCams babes and British porn stars on a cam show for a live phone sex experience.

Valuation and predictions

Through its first public offering (IPO) on February 12th 2021, Bumble raised $2.2 billion from investors, pricing the firm at $43 per share. The initial share price of the company immediately increased to $75.46 per share. Due to this it briefly ranked among the top 1,000 most valuable corporations in the world. Stock, however, dropped to below $40 per share and a worth of under $4 billion shortly after trading began. Researchers were able to correctly calculate it’s valuation each year from its start until when it became a publicly traded company by using the same data:

| Year | Valuation ($mm) |

| 2015 | 12.5 million[1] |

| 2016 | 200 million |

| 2017 | 1,000 million[2] |

| 2018 | 1,500 million |

| 2019 | 3,000 million |

| 2020 | 4,200 million[3] |

| 2021 | 8,100 million[4] |

| 2022 | 6,000 million |

| 2023 | 7,500 million |

| 2024 | 9,200 million |

| 2025 | 10,300 million |